The Great Deflation: Monetising Artificial Intelligence

AI will have a dramatic impact on monetisation but not in the way most expect - we will see the biggest impact on price levels not price models

Hey! It’s Andreas from Monetisation Matters, the home of in-depth articles and actionable insights on Strategy and Monetisation. Built for Founders, Product, and Product Marketing leaders as they navigate their $1m to $100m growth journeys. This month’s article dives into the impact of artificial intelligence on monetisation.

The crux

If the anticipated productivity shock from AI mirrors the scale of the Technological Revolution it will create deflationary pressure for entire economies, and cut prices at the knees in multiple industries. We will see much less dramatic shifts in pricing models - predictions of businesses embracing outcome-based pricing in particular are overblown.

The macro view

New technologies and the productivity we enjoy from them are built on the shoulders of giants. The AI revolution will build on the innovations that came before it. Technological progress and capital deepening i.e. augmenting labour with capital investments have played a major role in driving growth over the past 200 years.

Ln of GDP per capita in GBR 1700 to 2022

The Technological Revolution is a particularly interesting period to study. New manufacturing processes, increased electrification, adoption of telegraph networks and railroads, and greater coverage of basic utilities all played a part in driving massive increases in productivity. The productivity shock was so consequential that between 1870 and 1890 prices dropped by 0.40% per year on average. Some years saw decrease by as much as 4%.

GBR annual inflation during the Technological Revolution

“History doesn’t repeat itself, but it often rhymes”

Mark Twain

The nature of innovations ahead of us will obviously be unrecognisable to what emerged in the Technological Revolution. But if the depth and breadth of the coming productivity shock is comparable, we might see similar pressure on prices.

Despite expected productivity gains from AI, the overall picture for inflation is uncertain. We don’t know how monetary policy will develop, what a Trump Presidency will look like, in particular regarding trade. Additionally, energy starvation, overregulation and supply chain disruptions could all threaten the pace of AI adoption, meaning that productivity gains don’t materialise for some time.

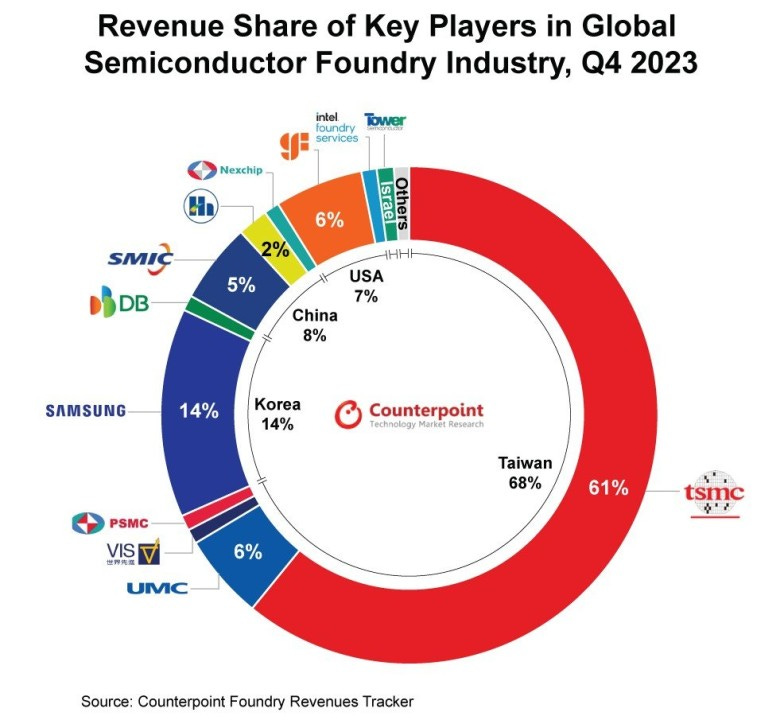

If the UK and Germany continue to commit slow national suicide through their respective energy policies, and the EU continues to overregulate then that’s bad news for Europe. If China blockades or invades Taiwan before TSMC can build up production capacity in the US and elsewhere it will be catastrophic for AI supply chains.

Energy starvation (source: Financial Times / BloombergNEF)

National suicide (source: Deutsche Bundesbank; Boom and Bust report)

Supply chain fragility (source: Counterpoint Foundry Revenues Tracker)

Putting aside any headwinds, AI adoption will flow through the economy as follows. Augmenting labour with AI will make workers more productive and increase growth rates. Increased output driven by productivity gains will allow the economy to increase savings, investment, and capital per unit of labour. Economies will move towards higher output, savings and investment as they realise the full potential of AI.

AI as a positive shock to productivity…

…which drives higher output and investment

AI related investment as % of GDP (source: Goldman Sachs)

As businesses become more productive, increased output will put downward pressure on prices. Either we will see deflation, or disinflation.

Increase in aggregate supply…

…puts downward pressure on price levels

The micro view

The irony is that the sectors and use cases which experience the greatest productivity gains are also the ones that will come under the most price pressure. 41% of code on Github is supposedly AI generated. If you can write more code with the same number of engineers, or hire fewer engineers for the same output, those lower costs will flow through into market prices. AI won’t just increase productivity in high tech industries - it will also have a profound effect on under-digitised yet essential industries. The same industries that drove productivity gains during the Technological Revolution.

Cogna, a precision software factory powered by AI is building applications for under-digitised industries such as utilities and construction. It can do so at 1/20th of the cost of software development consultancies. This isn’t fantasy, it’s happening right now. Not only will that put enormous pressure on price levels in the $363bn IT consultancy market, it will also open up new markets as the cost of custom applications becomes more accessible. Increased digitisation and productivity improvements in these vital industries will flow through to lower prices for consumers and businesses. The ability of AI to help citizens keep more money in their pockets through lower prices of life’s essentials is what in large part drives the founders of Cogna.

“Software has long been constrained by a shortage of engineers, leading to broad, configurable products that often compromise usability or require costly customisation. While demand for custom software exists, high costs have kept it inaccessible to most businesses, despite agile methods showing the value of iterative development.

AI is revolutionising this landscape by drastically reducing discovery, development, and iteration costs. This shift enables new use cases and leaner, more targeted solutions. At Cogna, we believe AI-powered, precision-built software can unlock unprecedented productivity, reduce costs, and enhance accessibility for businesses and consumers.”

Ben Peters, Co-founder & CEO of Cogna

AI’s impact will therefore be one of creative destruction. Any excess margins in the short term will be competed away as the underlying technology driving the revolution is available to everyone. Suppliers that grow margins through increased productivity will only keep hold of the gain if they posses market power. Amazingly, even a supplier with market power will reduce prices to increase volume in response to an increase in productivity. It’s profit maximising point will be a function of higher volumes at lower prices enabled by a lower cost base. However you look at it, prices are coming down.

Market power and monetisation

How you charge has nothing to do with developing market power. Your monetisation strategy determines how much value you capture, not how much you create. To argue otherwise is to get the relationship backwards.

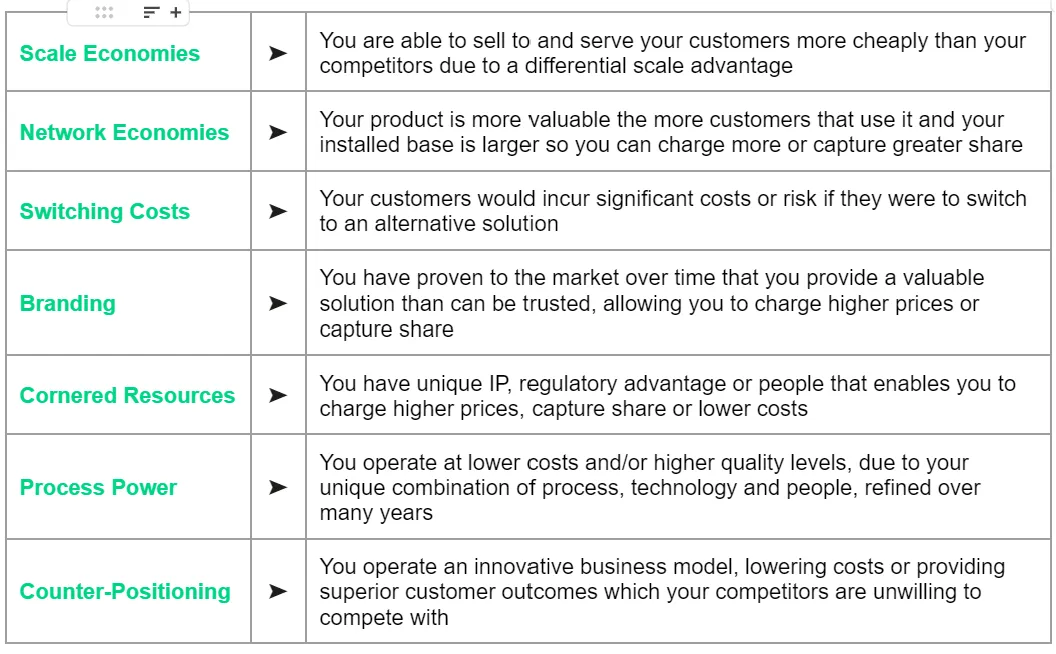

I care just as much about the things that stay the same than the things that will change. Principles that survive massive change are robust. We can trust them. The ways in which businesses generate market power is going to be completely unaffected by AI. I have great faith that Hamilton Helmer has already nailed it by identifying seven sources of power. AI will not make any of them more or less true, and does not suddenly open us up to a new eighth power. I’m not even sure any of them will become more or less important overall. We will probably see more counter-positioning as AI disrupts existing business models, but that will peter out. I’ve summarised Hamilton’s seven powers below if you are not familiar.

Developing market power is what secures profitability and market share in the long term. AI driven innovations will provide a window to do so, but won’t be enough on their own.

“People who invent a great new product add to the “giants shoulders” effect and that influences future inventions but usually not in a way that allows the full stream of profits from these future inventions to flow back to those who came up with the earlier inventions.”

Karl Whelan, Professor of Economics at University College Dublin

What you charge > how you charge

My former employer, Simon-Kucher & Partners, global leaders in monetisation have a saying: how you charge is more important than what you charge. But as I’ve laid out above, the creative destruction we will see as a result of AI will be driven by deflation not creative pricing models. Predictions of large scale shifts towards outcome-based pricing in particular are misplaced.

Pricing according to outcomes is nothing new. Businesses would love to price based on the true value they deliver: capturing a higher share for themselves. We don’t see it much because it’s hard to do. Artificial intelligence doesn’t make it any easier. So no, we aren’t going to suddenly see a huge shift towards outcome-based pricing.

“Outcome-based pricing isn’t new, despite hype suggesting groundbreaking innovation. Recruitment, real estate, and consignment sales have used it for years. However, it’s a poor fit for most things - especially in digital contexts and where event volumes are high, but values low. The fraud-plagued digital advertising market is a good example, where unclear attribution models created chaos. Emerging technologies like GenAI or "Agentic AI" don’t make this model any more viable. Unless you can clearly link costs, autonomous delivery, attributable outcomes, and value it’s best to steer clear for now.”

Marek Rubasinski, Head of EMEA m3ter

What we will see is a shift away from user-based pricing for propositions with a high degree of automation disconnected from labour intensity. However, it won’t disappear completely despite grand predictions on LinkedIn - it still makes sense for propositions that augment a worker’s productivity, blending man and machine. The argument that augmenting labour with AI drives a reduction in labour, so per user models aren’t suitable is erroneous. Labour intensity decreases and capital increases because of the productivity shock. Changing the model doesn’t mean more value is going to necessarily accrue to the supplier - market power matters much more than than the model.

The other argument I see for claiming per user or fixed subscription pricing is dead is that LLMs can drive material variable costs for the application layer. That is true but ignores dynamics. Variables costs will continue to come down as the technology matures. Look at what happened to mobile phone contracts over time. We saw a shift from pay-as-you-go to all you can eat per SIM contracts as investment increased, technology matured, and competition intensified. Same for broadband.

There is already a general shift towards usage-based and hybrid pricing models over the past few years, pre-dating the emergence of LLMs. According to OpenView’s “The State of Usage Based Pricing”, 61% of SaaS businesses already have some kind of usage element, and another 21% will experiment with it. AI will accelerate the adoption of hybrid models but did not start it. Counterintuitively, Geoffrey Moore argues we may see more fixed-fee models devoid of any creativity as AI eats into low-value billable hour services. Increased sophistication and flexibility in the quote-to-cash process is going to be a much more important driver of creative pricing in future than AI.

The desire for more imaginative pricing has always existed, but the Q2C tech stack has acted as an insurmountable barrier holding back a wave of creativity. That is why Notion Capital invested in m3ter, which automates complex bill calculation through a metering and rating engine. m3ter provides the missing puzzle pieces for suppliers to execute the pricing they believe is right, not just what their Q2C process allows.

I enjoy writing, but it is a tremendous investment. If you enjoyed this article, please consider sharing it with your colleagues and friends so that it may grow. Thank you.